Have you ever wondered what the difference is between finance and accounting? These two terms are often used interchangeably, but they actually have distinct meanings and roles in the business world. Understanding the nuances between finance and accounting can help you navigate the financial landscape with confidence. So, buckle up and let’s dive into the exciting realm of numbers and money!

When it comes to finance and accounting, think of them as two sides of the same coin. Finance focuses on the big picture, managing and analyzing the overall financial health of a company. It’s like the strategic mastermind behind the scenes, making decisions about investments, capital structure, and financial planning. On the other hand, accounting is the meticulous record-keeping and reporting side of the equation. Accountants are the detail-oriented superheroes who ensure that financial transactions are accurately recorded, budgets are followed, and financial statements are prepared. In a nutshell, finance is all about strategy and decision-making, while accounting is about tracking and reporting the financial facts and figures. So, let’s take a closer look at the key differences between finance and accounting and how they complement each other in the business world.

Understanding the Difference Between Finance and Accounting

Finance and accounting are two crucial aspects of any business organization. While they are closely related, there are distinct differences between the two disciplines. In this article, we will explore the disparities between finance and accounting, shedding light on their roles, functions, and the skills required to excel in each field.

The Role of Finance

Finance encompasses the management of money and assets within an organization. Professionals in the field of finance are responsible for making financial decisions that impact the overall profitability and growth of a business. They analyze financial data, assess risks, and develop strategies to maximize the value of investments.

Finance professionals play a critical role in budgeting, financial planning, and forecasting. They work closely with other departments to ensure that financial resources are allocated efficiently and effectively. In addition, they monitor and analyze market trends, economic indicators, and industry benchmarks to make informed decisions regarding investments, mergers, and acquisitions.

Financial Analysis and Reporting

One of the key responsibilities of finance professionals is to analyze and interpret financial data to provide insights and recommendations to stakeholders. They prepare financial statements, such as balance sheets, income statements, and cash flow statements, to provide a comprehensive view of a company’s financial performance. These reports help management, investors, and creditors to assess the financial health and stability of the organization.

Financial analysts also conduct ratio analysis, trend analysis, and benchmarking to evaluate the company’s financial performance against industry standards and competitors. They identify areas of improvement, cost-saving opportunities, and potential risks that may impact the organization’s financial stability.

Investment Management

Another important aspect of finance is investment management. Finance professionals analyze investment opportunities, assess the risk-return trade-off, and make recommendations on where to invest the company’s funds. They consider various factors, such as market conditions, industry trends, and the company’s financial goals, to develop investment strategies that align with the organization’s objectives.

Investment management involves portfolio diversification, asset allocation, and risk management. Finance professionals also evaluate the performance of investments, monitor market trends, and make adjustments to the portfolio as needed. Their goal is to generate maximum returns while minimizing risks.

The Role of Accounting

While finance focuses on the management of money and assets, accounting is primarily concerned with recording, classifying, and reporting financial transactions. Accountants provide accurate and timely financial information that enables businesses to make informed decisions and comply with legal and regulatory requirements.

Accounting professionals are responsible for maintaining financial records, such as general ledgers, accounts payable, and accounts receivable. They ensure that transactions are properly recorded, categorized, and summarized in accordance with accounting principles and standards. This includes preparing financial statements, reconciling accounts, and conducting audits to ensure the accuracy and integrity of financial data.

Financial Control and Compliance

Accounting plays a crucial role in ensuring financial control and compliance within an organization. Accountants establish internal controls to safeguard assets, prevent fraud, and maintain the integrity of financial information. They develop and implement accounting policies and procedures to ensure transparency, accuracy, and consistency in financial reporting.

Accounting professionals also ensure compliance with tax laws and regulations. They prepare tax returns, calculate tax liabilities, and maintain records to support tax filings. Additionally, they collaborate with external auditors to conduct financial audits and ensure compliance with auditing standards.

Financial Planning and Budgeting

Accounting professionals are involved in the financial planning and budgeting process. They work closely with finance teams to develop budgets, monitor expenses, and track variances. Accountants analyze historical financial data, assess future financial needs, and provide insights to support decision-making.

Furthermore, accountants play a crucial role in cost accounting and cost management. They analyze costs, identify cost-saving opportunities, and implement strategies to improve the organization’s financial performance. Through effective budgeting and cost control measures, accountants contribute to the overall financial stability and success of the organization.

In summary, while finance and accounting are closely related, they have distinct roles and responsibilities within an organization. Finance focuses on financial decision-making, investment management, and financial analysis, while accounting is primarily concerned with recording, classifying, and reporting financial transactions. Both disciplines are essential for the financial health and success of a business, and professionals in these fields work collaboratively to achieve the organization’s objectives.

Key Takeaways: What is the Difference Between Finance and Accounting?

- Finance focuses on managing funds and investments, while accounting focuses on recording and analyzing financial transactions.

- Finance deals with making financial decisions, such as investments and budgeting, while accounting focuses on preparing financial statements and reports.

- Finance professionals often work with financial markets and institutions, while accountants work within organizations to maintain financial records.

- Finance requires a broader understanding of the financial system, while accounting requires a strong attention to detail and accuracy.

- In summary, finance is about managing money and making decisions, while accounting is about recording and analyzing financial data.

Frequently Asked Questions

Many people often confuse the terms “finance” and “accounting” as they both deal with the financial aspects of a business. However, they are distinct fields with different focuses and responsibilities. In this article, we will explore the key differences between finance and accounting to help clarify their roles and functions.

Question 1: What is finance?

Finance is a broad field that encompasses the management of money, investments, and financial resources within an organization. It focuses on making decisions related to raising and allocating funds, evaluating investment opportunities, and managing financial risks. Finance professionals analyze financial data, develop financial strategies, and provide guidance on financial decisions.

Finance is concerned with the overall financial health of a business and aims to maximize shareholder value through effective financial management. It involves activities such as budgeting, forecasting, financial planning, and capital budgeting. Finance professionals also play a role in mergers and acquisitions, financial reporting, and financial analysis.

Question 2: What is accounting?

Accounting, on the other hand, is the process of recording, summarizing, and reporting financial transactions of a business. It involves maintaining accurate and systematic records of financial activities, including purchases, sales, expenses, and revenues. Accounting professionals ensure that financial statements are prepared in accordance with relevant accounting principles and regulations.

Accounting provides essential information for decision-making, internal control, and compliance purposes. It includes activities such as bookkeeping, financial statement preparation, auditing, and tax compliance. Accountants analyze financial data, prepare financial reports, and provide insights into the financial performance and position of a business.

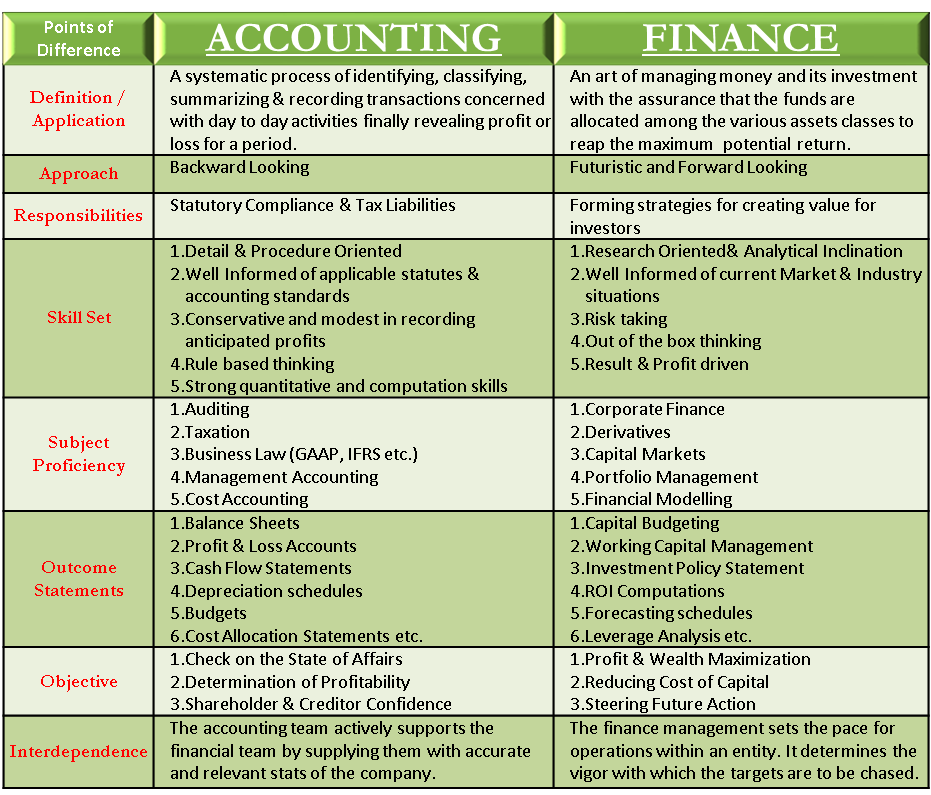

Question 3: What are the key differences between finance and accounting?

While finance and accounting are closely related, there are several key differences between the two:

Focus: Finance focuses on the management of financial resources and making strategic decisions to achieve the organization’s financial goals. Accounting, on the other hand, focuses on the accurate recording and reporting of financial transactions.

Scope: Finance is broader in scope and covers activities such as financial planning, investment analysis, and risk management. Accounting is more specific and concentrates on the preparation and presentation of financial statements.

Time Horizon: Finance deals with both short-term and long-term financial decisions, considering the future implications of these decisions. Accounting, on the other hand, primarily deals with past financial transactions and their recording.

Responsibilities: Finance professionals are responsible for making financial decisions, analyzing financial data, and providing financial guidance. Accountants are responsible for recording financial transactions, preparing financial statements, and ensuring compliance with accounting standards.

Question 4: Can someone work in both finance and accounting?

Yes, it is possible for someone to work in both finance and accounting, as the two fields are closely related and often overlap. Many professionals have knowledge and skills in both areas, allowing them to contribute to various aspects of financial management within an organization. However, it is important to note that finance and accounting require different skill sets and expertise, and individuals may choose to specialize in one field or the other.

Working in both finance and accounting can provide a holistic understanding of a business’s financial operations and enable professionals to make well-informed financial decisions.

Question 5: How do finance and accounting collaborate?

Finance and accounting departments within an organization often collaborate closely to ensure the financial health and success of the business. While their roles may be distinct, they rely on each other’s expertise and information to fulfill their respective responsibilities.

Accounting provides accurate financial data and prepares financial statements that finance professionals use for analysis and decision-making. Finance professionals, in turn, provide guidance and strategic insights to accountants regarding financial planning, budgeting, and investment decisions.

Effective collaboration between finance and accounting ensures the accurate recording and reporting of financial transactions, informed financial decision-making, and compliance with financial regulations and standards.

Accounting vs. Finance: What’s the Difference?

Final Thoughts: Understanding the Difference Between Finance and Accounting

When it comes to the world of numbers and money, finance and accounting often get intertwined and confused. However, it’s crucial to recognize that these two fields are distinct in their focus and purpose. While both finance and accounting play essential roles in managing and analyzing financial information, they serve different functions within an organization.

In conclusion, finance is the strategic side of the financial world, focusing on the big picture and long-term planning. It involves making financial decisions, managing investments, and assessing the overall financial health of a company. On the other hand, accounting is more focused on the day-to-day operations, recording and reporting financial transactions, and ensuring accuracy and compliance with regulations.

So, next time you come across these two terms, remember that finance is like the captain steering the ship, while accounting is like the navigator meticulously charting the course. Understanding their unique roles and responsibilities will help you navigate the complex world of finance and accounting with confidence.