So, you’re ready to take your business to the next level and secure a loan? That’s fantastic! But before you can dive into the world of financing, you need to have a solid business plan in place. Don’t worry, though – I’ve got you covered. In this article, we’re going to dive into the nitty-gritty details of how to write a business plan for a loan that will impress lenders and increase your chances of securing the funds you need.

Crafting a business plan can seem like a daunting task, but fear not! I’m here to guide you through the process step by step. We’ll cover everything from the executive summary to financial projections and market analysis. By the time you’re done, you’ll have a comprehensive and persuasive plan that will not only attract lenders but also serve as a roadmap for your own success. So, grab a pen and some paper, and let’s get started on this exciting journey to financial growth!

How to Write a Business Plan for a Loan

- Understand the purpose: Start by understanding the purpose of your business plan for a loan. This will help you align your goals and objectives with the lender’s requirements.

- Research and gather information: Conduct thorough market research, analyze your industry, and gather all the necessary data and information to support your business plan.

- Outline your plan: Create a detailed outline that includes sections such as executive summary, company description, market analysis, product/service offerings, marketing strategy, financial projections, and more.

- Write the content: Begin writing each section of your business plan, ensuring that you provide clear and concise information. Use headings, subheadings, and bullet points to make it easier to read and understand.

- Edit and revise: Review your business plan several times, checking for any errors or inconsistencies. Make sure the plan is well-structured and conveys a strong message.

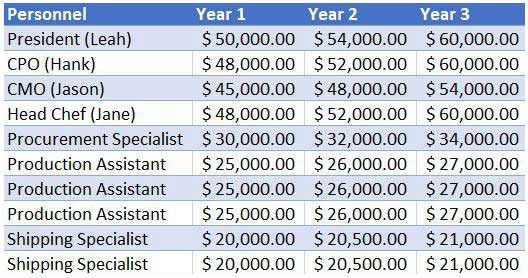

- Include financial projections: Provide realistic financial projections, including income statements, balance sheets, and cash flow statements. Be prepared to explain your assumptions and projections to the lender.

- Seek feedback: Share your business plan with trusted advisors or professionals in your industry. Their feedback can help you strengthen your plan and address any potential issues.

- Finalize and submit: Once you are satisfied with your business plan, finalize it by proofreading and formatting it properly. Then, submit it to the lender along with any required supporting documents.

How to Write a Business Plan for a Loan?

Understanding the Importance of a Business Plan

A business plan is a crucial document that outlines the details of your business, including its goals, strategies, and financial projections. When applying for a loan, having a well-written business plan can greatly increase your chances of approval. It demonstrates to lenders that you have a clear vision for your business and have done thorough research and analysis. Additionally, a business plan helps you stay organized and focused on your goals, acting as a roadmap for success.

To write an effective business plan for a loan, it is important to understand the key components that should be included. These components typically include an executive summary, company description, market analysis, organization and management structure, product or service offerings, marketing and sales strategies, financial projections, and funding requirements. Each section plays a vital role in showcasing the viability and potential profitability of your business.

The Executive Summary

The executive summary is a concise overview of your business plan and should provide a clear and compelling summary of your business concept. It should include key information such as your business name, location, mission statement, target market, and unique selling proposition. This section is often the first thing lenders read, so it’s important to make a strong impression. Highlight the key points of your business plan and emphasize the potential for profitability and growth.

In the executive summary, you should also outline your funding requirements, including the amount of loan you are seeking and how the funds will be used. It’s important to be specific and provide a detailed breakdown of expenses, such as equipment purchases, marketing costs, and working capital. Lenders want to see that you have a clear understanding of your financial needs and have carefully considered how the loan will be utilized to support your business growth.

The Company Description

The company description section provides an overview of your business, its history, and its mission. This is your opportunity to showcase the unique aspects of your business that differentiate it from competitors. Discuss the products or services you offer, your target market, and any competitive advantages you have. Highlight your business’s strengths and explain how you plan to capitalize on market opportunities.

In this section, you should also include information about your management team and their qualifications. Lenders want to see that you have a capable and experienced team in place to successfully run the business. Provide brief bios of key team members and highlight their relevant skills and expertise. This will give lenders confidence in your ability to execute your business plan and achieve success.

Overall, writing a business plan for a loan requires careful consideration and attention to detail. By following a structured approach and including all the necessary components, you can create a compelling and persuasive document that increases your chances of securing the funding you need for your business. Remember to be thorough in your research, realistic in your financial projections, and confident in your business concept.

Key Takeaways: How to Write a Business Plan for a Loan?

- Understand the purpose of your business plan: To secure a loan, your business plan should demonstrate the potential for profitability and repayment.

- Include an executive summary: This section provides a concise overview of your business, highlighting key points.

- Describe your business: Detail your products or services, target market, competition, and how your business will operate.

- Provide financial projections: Show lenders your expected revenue, expenses, and cash flow to support loan repayment.

- Include supporting documents: Attach relevant documents such as market research, resumes, and financial statements.

Frequently Asked Questions

What information should be included in a business plan for a loan?

When writing a business plan for a loan, it is important to include key information that will help lenders assess the viability of your business and its ability to repay the loan. Here are some key sections and information that should be included:

1. Executive Summary: Provide a brief overview of your business, including its mission, products or services, target market, and financial projections.

2. Company Description: Describe your business in detail, including its legal structure, ownership, history, and any unique selling points.

3. Market Analysis: Conduct thorough research on your target market, industry trends, and competitors to demonstrate your understanding of the market and your competitive advantage.

4. Products or Services: Explain what you offer, how it meets customer needs, and any intellectual property or patents associated with your products or services.

5. Financial Projections: Include detailed financial forecasts such as income statements, balance sheets, cash flow statements, and break-even analysis to show your business’s financial health and growth potential.

How should I structure my business plan for a loan?

Structuring your business plan for a loan is essential to ensure it is well-organized and easy to understand for lenders. Here is a suggested structure:

1. Executive Summary: Provide a concise overview of your business and its potential for success.

2. Company Description: Describe your business, its history, ownership structure, and unique selling points.

3. Market Analysis: Conduct thorough research on your target market, industry trends, and competitors to demonstrate your understanding of the market.

4. Products or Services: Explain what you offer, how it meets customer needs, and any intellectual property or patents associated with your products or services.

5. Marketing and Sales Strategy: Outline your marketing and sales approach, including pricing, distribution channels, and promotional activities.

6. Financial Projections: Include detailed financial forecasts showcasing revenue projections, expenses, and profitability.

7. Funding Request: Clearly state the amount of funding you are seeking and how it will be used.

8. Appendix: Include any additional supporting documents, such as resumes, market research data, or legal agreements.

What are the key elements of a financial projection in a business plan for a loan?

A financial projection is a crucial component of a business plan for a loan. It provides lenders with insights into your business’s financial health and growth prospects. Key elements to include in your financial projection are:

1. Income Statement: This shows your projected revenue, expenses, and net profit over a specific period, typically for the next three to five years.

2. Balance Sheet: This provides a snapshot of your business’s assets, liabilities, and equity at a specific point in time.

3. Cash Flow Statement: This tracks the movement of cash into and out of your business, including operating activities, investing activities, and financing activities.

4. Break-Even Analysis: This helps determine the point at which your business’s revenue equals its expenses, indicating when it will start generating profit.

5. Sales Forecast: This predicts your anticipated sales volume and revenue based on market research, historical data, and projected market trends.

6. Expense Budget: This outlines your anticipated expenses, including fixed costs (rent, salaries) and variable costs (materials, utilities), helping you assess your funding needs.

What are some tips for writing an effective business plan for a loan?

Writing an effective business plan for a loan requires careful planning and attention to detail. Here are some tips to help you craft a compelling plan:

1. Research and Preparation: Thoroughly research your business, target market, and industry to gather the necessary information for your plan.

2. Be Clear and Concise: Use clear and concise language to communicate your ideas effectively, avoiding jargon or technical terms that lenders may not understand.

3. Showcase Your Expertise: Highlight your experience, skills, and qualifications to demonstrate your ability to successfully run the business.

4. Provide Realistic Financial Projections: Ensure your financial projections are based on thorough research and realistic assumptions to give lenders confidence in your business’s potential for success.

5. Edit and Proofread: Review your business plan multiple times for errors, inconsistencies, and clarity. Consider seeking feedback from a mentor or professional to improve its quality.

What should I include in the executive summary of my business plan for a loan?

The executive summary is a crucial part of your business plan for a loan as it provides an overview of your entire plan. Include the following key information:

1. Business Description: Provide a brief description of your business, its mission, products or services, and target market.

2. Financial Snapshot: Summarize your financial projections, including revenue, expenses, and profitability.

3. Funding Request: Clearly state the amount of funding you are seeking and how it will be used.

4. Business Highlights: Highlight key achievements, milestones, or unique selling points that set your business apart.

5. Management Team: Briefly introduce your management team and their relevant experience and qualifications.

Remember, the executive summary should be concise, compelling, and grab the attention of lenders, enticing them to read the full business plan.

Write a Business Plan for Loan approval | Get Funded Program

Final Thoughts

After learning about how to write a business plan for a loan, it’s clear that this process is essential for any entrepreneur looking to secure funding. A well-crafted business plan not only demonstrates your vision and strategy but also proves to lenders that you have a solid understanding of your market and potential for success. By following the steps outlined in this article, you can create a comprehensive and persuasive business plan that increases your chances of obtaining the loan you need.

Remember, a successful business plan highlights your unique value proposition, market analysis, financial projections, and operational details. It’s important to tailor your plan to the specific requirements of your lender and to showcase your passion and commitment to your business. By incorporating SEO best practices, such as using relevant keywords and formatting your content for search engine optimization, you can also increase the visibility of your business plan online and attract potential investors.

In conclusion, writing a business plan for a loan is a crucial step in the entrepreneurial journey. It not only helps you clarify your goals and strategies but also serves as a powerful tool to attract lenders and investors. By utilizing the tips and techniques discussed in this article, you can create a compelling business plan that showcases your potential and sets you up for success. So, roll up your sleeves, put your ideas on paper, and get ready to take your business to new heights with a well-crafted business plan. Good luck!