Are you a mortgage professional looking to boost your business? Well, you’ve come to the right place! Today, we’re going to dive into the exciting world of lead generation and explore the question: “How to generate mortgage leads?” Generating mortgage leads is like finding the golden ticket to success in the industry. It’s the key to expanding your client base, increasing your sales, and ultimately growing your business. So, if you’re ready to take your mortgage business to the next level, buckle up and let’s explore some tried-and-true strategies for generating mortgage leads!

In this article, we’ll uncover the secrets to generating mortgage leads that will have potential clients knocking on your door. We’ll discuss a variety of strategies, from traditional methods to cutting-edge digital techniques. Whether you’re a seasoned mortgage professional or just starting out, we’ve got you covered. So, grab a cup of coffee, sit back, and get ready to learn how to generate mortgage leads like a pro! But first, let’s understand the importance of mortgage leads and why they are the lifeblood of your business.

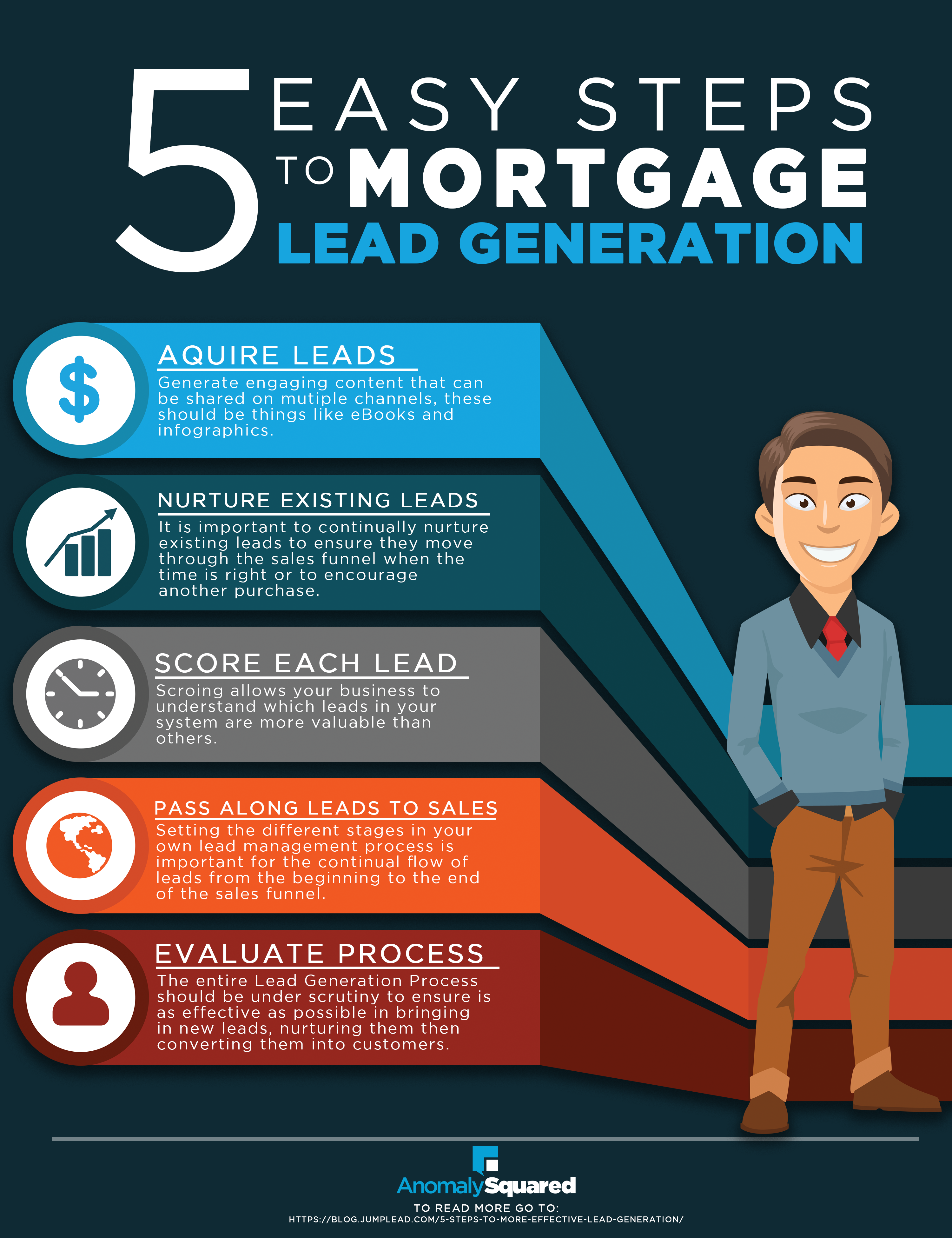

Looking to generate mortgage leads? Follow these simple steps to boost your lead generation efforts:

- Identify your target audience: Determine who your ideal mortgage clients are to tailor your marketing efforts.

- Create compelling content: Provide valuable information through blog posts, videos, and guides to attract potential leads.

- Optimize your website: Ensure your website is user-friendly, mobile-responsive, and optimized for search engines.

- Utilize social media: Engage with potential leads on platforms like Facebook, Instagram, and LinkedIn.

- Offer lead magnets: Provide free resources such as e-books or webinars in exchange for contact information.

- Collaborate with industry professionals: Partner with real estate agents or financial advisors to expand your reach.

Introduction

In the competitive mortgage industry, generating leads is crucial for success. With the right strategies and techniques, you can attract potential clients and increase your chances of closing deals. In this article, we will explore effective ways to generate mortgage leads and boost your business.

1. Optimize Your Website

Your website is the face of your business in the digital world. To generate mortgage leads, it’s essential to optimize your website for search engines and user experience. Start by conducting keyword research to identify relevant terms that potential clients may use when searching for mortgage services. Incorporate these keywords naturally into your website content, including your homepage, services pages, and blog posts.

Additionally, ensure that your website is mobile-friendly and loads quickly. A responsive design will provide a seamless experience for users on different devices, increasing the chances of capturing their attention and converting them into leads.

1.1 Utilize Landing Pages

Landing pages are an effective tool for lead generation. Create dedicated landing pages that cater to specific mortgage services or target demographics. Each landing page should have a clear call-to-action (CTA) and a lead capture form where visitors can submit their contact information in exchange for valuable content or a consultation.

Remember to highlight the benefits of your mortgage services and address any potential concerns or questions that your target audience may have. By providing valuable information and addressing their needs, you can establish trust and credibility, increasing the likelihood of converting leads into clients.

1.2 Implement Live Chat

Integrating live chat functionality on your website allows you to engage with potential leads in real-time. It provides an opportunity to answer their questions, address concerns, and guide them through the mortgage application process. Be sure to have knowledgeable and friendly staff available to handle live chat inquiries promptly.

By offering personalized assistance, you can build rapport and trust with potential clients, increasing the chances of converting them into qualified leads.

2. Create Compelling Content

Content marketing is a powerful tool for attracting and engaging potential mortgage leads. By creating valuable and informative content, you can position yourself as an industry expert and establish credibility. Consider the following content strategies:

2.1 Blogging: Maintain a blog on your website and regularly publish articles that address common mortgage questions, provide tips for homebuyers, and offer insights into the mortgage process. Optimize your blog posts with relevant keywords to improve their visibility in search engine results.

2.2 Videos: Create engaging videos that explain complex mortgage concepts, showcase success stories, or provide virtual tours of properties. Video content is highly shareable and can help expand your reach to a wider audience.

2.3 Case Studies

Share case studies that highlight successful mortgage transactions you have facilitated. Showcase the challenges faced, the solutions provided, and the positive outcomes. This will demonstrate your expertise and build trust with potential leads who may be facing similar situations.

Remember to optimize your content for search engines by including relevant keywords and meta tags. Regularly promoting your content through social media channels and email marketing campaigns will help drive traffic to your website and generate leads.

3. Leverage Social Media

Social media platforms provide an excellent opportunity to connect with potential mortgage leads and build brand awareness. Create profiles on platforms relevant to your target audience, such as Facebook, LinkedIn, and Instagram. Regularly share informative and engaging content, including blog posts, videos, and industry news.

Engage with your audience by responding to comments, messages, and inquiries promptly. By establishing an active and responsive social media presence, you can foster relationships with potential leads and position yourself as a trusted resource in the mortgage industry.

3.1 Facebook Ads

Consider running targeted Facebook ads to reach a specific demographic of potential leads. Utilize the platform’s advanced targeting options to narrow down your audience based on factors such as location, age, income, and interests. Craft compelling ad copy and visuals to capture attention and entice users to click through to your landing pages.

Remember to track and analyze the performance of your ads to optimize your targeting and messaging for maximum lead generation.

3.2 LinkedIn Networking

LinkedIn is a valuable platform for connecting with professionals in the real estate and mortgage industry. Join relevant groups and actively participate in discussions by providing insightful comments and sharing valuable content. By establishing yourself as a knowledgeable and helpful resource, you can attract the attention of potential leads and foster valuable connections.

Utilize LinkedIn’s messaging feature to reach out to individuals who may be interested in your mortgage services. Personalize your messages and offer something of value, such as a free consultation or access to exclusive content, to entice them to engage with you.

4. Collaborate with Realtors and Referral Partners

Building relationships with realtors, financial advisors, and other professionals in related industries can significantly boost your mortgage lead generation efforts. Reach out to local real estate agents and offer to collaborate on marketing campaigns or joint educational events.

Establishing referral partnerships can also be beneficial. By offering incentives for referrals, such as a commission or gift card, you can encourage your existing clients and network to refer potential leads to you.

4.1 Attend Networking Events

Networking events provide an opportunity to connect with professionals in the real estate and mortgage industry face-to-face. Attend local industry events, conferences, and trade shows to expand your network and generate leads through in-person interactions.

Be prepared with business cards, elevator pitches, and a genuine interest in building relationships. Remember to follow up with your new contacts after the event to nurture the connections and explore potential collaboration opportunities.

5. Utilize Online Advertising

Online advertising platforms, such as Google Ads and Bing Ads, allow you to target potential leads actively searching for mortgage services. Craft compelling ad copy and select relevant keywords to ensure your ads appear prominently in search engine results.

Consider utilizing remarketing campaigns to reach individuals who have previously visited your website. By displaying targeted ads to these potential leads, you can stay top-of-mind and increase the likelihood of conversion.

5.1 Display Ads

In addition to search ads, consider running display ads on relevant websites and platforms. Display ads can help increase brand awareness and capture the attention of potential leads who may be browsing websites related to real estate or finance.

Ensure your display ads are visually appealing and include a clear call-to-action that directs users to a landing page where they can submit their contact information.

6. Track and Analyze Your Results

Tracking and analyzing your lead generation efforts is essential to identify what strategies are working and where improvements can be made. Utilize website analytics tools, such as Google Analytics, to monitor website traffic, conversion rates, and user behavior.

Pay attention to the sources of your leads and the performance of different marketing channels. This data will help you optimize your lead generation strategies and allocate your resources effectively.

6.1 A/B Testing

Conduct A/B testing to compare the effectiveness of different landing pages, ad copies, and call-to-action buttons. By testing different variations, you can identify the elements that resonate most with your target audience and optimize your lead generation campaigns accordingly.

Regularly review and update your lead generation strategies based on the insights gained from tracking and analysis. Continuously adapt and refine your approach to ensure you are consistently generating high-quality mortgage leads.

Conclusion

Generating mortgage leads requires a strategic and multifaceted approach. By optimizing your website, creating compelling content, leveraging social media, collaborating with referral partners, utilizing online advertising, and tracking your results, you can attract qualified leads and grow your mortgage business. Implement these strategies consistently and adapt them to your target audience to maximize your lead generation efforts.

Key Takeaways: How to Generate Mortgage Leads?

- Creating a professional website with valuable content and a lead capture form.

- Utilizing social media platforms to promote your mortgage services and engage with potential leads.

- Implementing search engine optimization strategies to improve your website’s visibility and attract organic traffic.

- Networking with real estate agents, financial advisors, and other professionals in the industry to generate referrals.

- Offering incentives such as free consultations or educational resources to entice potential leads to provide their contact information.

Frequently Asked Questions

Question 1: What are some effective strategies to generate mortgage leads?

There are several strategies you can employ to generate mortgage leads. Firstly, you can create an engaging and informative website that provides valuable content related to mortgages. This will help attract potential leads who are actively searching for mortgage information online. Additionally, you can leverage social media platforms to engage with your target audience and share valuable content.

Another effective strategy is to partner with real estate agents or brokers. By establishing relationships with these professionals, you can receive referrals and gain access to a wider network of potential leads. Lastly, consider attending local networking events or industry conferences to connect with individuals who may be in need of mortgage services.

Question 2: How can I optimize my website to generate more mortgage leads?

To optimize your website for lead generation, start by conducting keyword research to identify relevant terms that potential leads may be searching for. Incorporate these keywords naturally throughout your website’s content, including in titles, headings, and meta tags.

In addition, ensure your website is user-friendly and mobile-responsive. This is crucial as more and more people are accessing the internet through mobile devices. Make sure your website loads quickly and is easy to navigate, providing a seamless experience for visitors.

Question 3: What role does email marketing play in generating mortgage leads?

Email marketing can be a powerful tool for generating mortgage leads. Start by building an email list of interested individuals who have willingly provided their contact information. You can offer valuable resources or incentives, such as a mortgage guide or a free consultation, in exchange for their email address.

Once you have a list, create personalized and targeted email campaigns. Provide valuable content, such as tips for first-time homebuyers or updates on mortgage rates, to keep your leads engaged. Additionally, use email automation to nurture leads over time and convert them into clients.

Question 4: How can I leverage social media to generate mortgage leads?

Social media platforms offer great opportunities to connect with potential mortgage leads. Start by creating professional profiles on platforms such as Facebook, Instagram, and LinkedIn. Share valuable content related to mortgages, such as tips for getting approved or the benefits of homeownership.

Engage with your audience by responding to comments and messages promptly. Additionally, consider running targeted ads on social media platforms to reach a wider audience. Use demographic and interest-based targeting to ensure your ads are shown to individuals who are likely to be interested in mortgage services.

Question 5: How can networking help in generating mortgage leads?

Networking can be a powerful tool for generating mortgage leads. Attend local networking events or join industry-related organizations to connect with professionals and potential clients. Establish relationships with real estate agents, brokers, and other professionals in the real estate industry who can refer clients to you.

Additionally, consider hosting your own networking events or workshops where you can showcase your expertise and provide value to attendees. This can help position you as a trusted authority in the mortgage industry and attract potential leads.

Final Summary: Unlocking the Secrets to Generating Mortgage Leads

So, there you have it! We’ve explored the ins and outs of how to generate mortgage leads and uncovered some powerful strategies to help you succeed in this competitive industry. By implementing these techniques, you’ll be well on your way to attracting high-quality leads and growing your business.

First and foremost, optimizing your online presence is key. Creating a user-friendly website that is both informative and visually appealing will not only impress potential clients but also improve your search engine rankings. Don’t forget to incorporate relevant keywords throughout your website to maximize your visibility on search engines like Google.

Additionally, leveraging the power of social media is crucial in today’s digital age. Engage with your audience on platforms like Facebook, Instagram, and LinkedIn, and provide valuable content that addresses their pain points and offers solutions. Build a strong online community that trusts and values your expertise, and watch as your lead generation efforts soar.

Remember, generating mortgage leads is a continuous process that requires dedication and creativity. By staying up to date with the latest industry trends and continuously refining your strategies, you’ll be able to adapt to the ever-changing landscape and stay ahead of the competition.

So, what are you waiting for? Start implementing these tactics today and watch as your mortgage leads multiply. Happy lead generation!