So, you want to learn how to budget money, huh? Well, you’ve come to the right place! Budgeting is an essential skill that everyone should master, especially if you’re just starting out on your financial journey. Don’t worry if you’re feeling a little overwhelmed or clueless about where to begin. In this article, we’ll break down the basics of budgeting for beginners and provide you with practical tips to get you on the right track.

Money management doesn’t have to be boring or complicated. In fact, it can be quite empowering once you get the hang of it. We’ll show you how to take control of your finances and make your money work for you. Whether you’re trying to save for a big purchase, pay off debt, or simply build up your savings, having a budget in place is the first step towards achieving your financial goals. So, grab a pen and paper, and let’s dive into the wonderful world of budgeting!

How to Budget Money for Beginners: A Step-by-Step Guide

- Track Your Income and Expenses: Start by listing all your sources of income and tracking your expenses to understand where your money is going.

- Create a Budget: Set financial goals and allocate your income to different categories such as housing, transportation, groceries, etc.

- Reduce Unnecessary Expenses: Identify and cut back on non-essential spending to free up more money for savings.

- Build an Emergency Fund: Set aside a portion of your income for unexpected expenses or emergencies.

- Pay Off Debt: Prioritize debt repayment to reduce interest payments and improve your financial situation.

- Save for the Future: Start saving for retirement or other long-term goals to secure your financial future.

- Review and Adjust: Regularly review your budget and make adjustments as needed to stay on track.

How to Budget Money for Beginners: A Step-by-Step Guide

Budgeting is an essential skill that everyone should learn, especially beginners who are just starting to take control of their finances. Creating and sticking to a budget can help you achieve your financial goals, pay off debt, and build wealth. In this article, we will provide you with a comprehensive guide on how to budget money for beginners, covering the key steps and strategies to help you get started on the right track.

Step 1: Set Your Financial Goals

The first step in budgeting is to determine your financial goals. What do you want to achieve with your money? Do you want to save for a down payment on a house, pay off your student loans, or start an emergency fund? Clearly defining your goals will give you a sense of purpose and motivation to stick to your budget.

Identify both short-term and long-term goals. Short-term goals can be achieved within a year or less, while long-term goals may take several years to accomplish. Write down your goals and assign a timeline and a dollar amount to each one. This will serve as a roadmap for your budgeting journey.

Step 1.1: Prioritize Your Goals

Once you have identified your financial goals, it’s important to prioritize them. Determine which goals are most important to you and rank them accordingly. This will help you allocate your resources and make decisions about where to focus your money. Remember, you may not be able to achieve all of your goals at once, so it’s crucial to prioritize and focus on what matters most to you.

Step 1.2: Make Your Goals SMART

To increase your chances of achieving your financial goals, make them SMART: Specific, Measurable, Attainable, Relevant, and Time-bound. For example, instead of saying, “I want to save for a vacation,” make it more specific by saying, “I want to save $3,000 for a vacation to Hawaii within the next 12 months.” This will make your goals more actionable and easier to track.

Step 2: Track Your Income and Expenses

In order to create an effective budget, you need to have a clear understanding of your income and expenses. Start by tracking your income, which includes your salary, side hustle earnings, rental income, or any other sources of income. Make sure to include all sources to get an accurate picture of your cash inflow.

Next, track your expenses. This can be done by reviewing your bank statements, credit card statements, and receipts. Categorize your expenses into different categories such as housing, transportation, groceries, entertainment, and debt payments. This will help you identify areas where you may be overspending and areas where you can cut back.

Step 2.1: Use Budgeting Tools and Apps

There are numerous budgeting tools and apps available that can help you track your income and expenses more efficiently. These tools can automatically sync with your bank accounts and credit cards, categorize your transactions, and provide you with visual representations of your spending. Some popular budgeting apps include Mint, YNAB (You Need a Budget), and Personal Capital.

Step 2.2: Review Your Spending Habits

As you track your expenses, take the time to review your spending habits. Are there any areas where you are overspending? Are there any unnecessary expenses that can be eliminated? Look for opportunities to reduce your spending and reallocate those funds towards your financial goals. This could mean cutting back on dining out, canceling unused subscriptions, or finding more affordable alternatives.

Step 3: Create a Budget

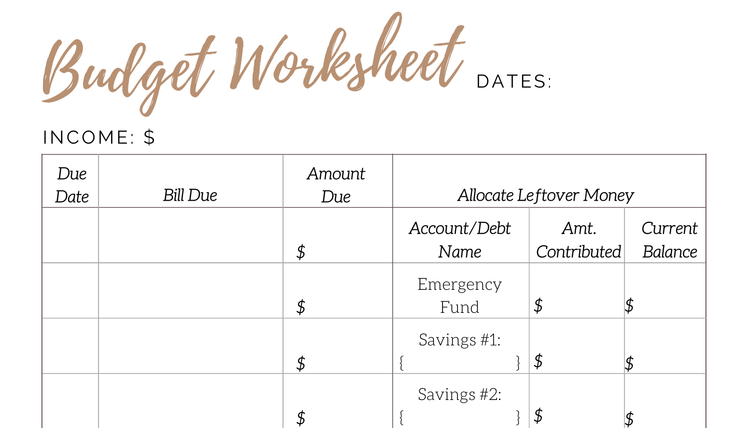

Now that you have a clear understanding of your income and expenses, it’s time to create a budget. A budget is a plan that outlines how you will allocate your income towards your expenses and financial goals. Start by listing your income at the top of the budget and then subtract your fixed expenses such as rent or mortgage payments, utilities, and debt payments.

Next, allocate funds towards your financial goals. Set aside a certain amount each month for each goal and make it a priority to contribute to those funds. Finally, allocate the remaining funds towards your variable expenses such as groceries, transportation, and entertainment. It’s important to be realistic and flexible with your budget, as unexpected expenses may arise.

Step 3.1: Use the 50/30/20 Rule

If you’re not sure how to allocate your income, you can use the 50/30/20 rule as a guideline. This rule suggests that you allocate 50% of your income towards needs, 30% towards wants, and 20% towards savings and debt repayment. Adjust these percentages based on your specific financial situation and goals.

Step 3.2: Automate Your Savings

To make saving easier, consider automating your savings. Set up automatic transfers from your checking account to your savings account each month. This way, you won’t have to rely on willpower to save; it will happen automatically. Start with a small amount and gradually increase it over time as you become more comfortable with saving.

Step 4: Review and Adjust Your Budget Regularly

Budgeting is not a one-time task; it requires regular review and adjustments. Take the time each month to review your budget and compare your actual spending to your budgeted amounts. This will help you identify areas where you may be overspending and areas where you can cut back.

Make adjustments to your budget as needed. If you consistently find yourself overspending in a certain category, consider increasing the budgeted amount for that category or finding ways to reduce your spending. On the other hand, if you consistently have extra funds left over, consider reallocating those funds towards your financial goals or increasing your savings.

Step 4.1: Involve Your Partner or Family

If you have a partner or family, it’s important to involve them in the budgeting process. Discuss your goals and priorities together and make joint decisions about how to allocate your resources. This will help ensure that everyone is on the same page and committed to sticking to the budget.

Step 4.2: Seek Professional Help if Needed

If you find budgeting overwhelming or if you need help with more complex financial situations, don’t hesitate to seek professional help. A financial advisor or a certified financial planner can provide personalized guidance and expertise to help you navigate your financial journey.

By following these steps, you will be well on your way to budgeting success. Remember, budgeting is a skill that takes time and practice to master. Be patient with yourself and celebrate small wins along the way. With dedication and consistency, you can achieve your financial goals and take control of your money.

Key Takeaways: How to Budget Money for Beginners

- Start by tracking your expenses to understand where your money is going.

- Create a budget by listing your income and expenses.

- Set financial goals to help prioritize your spending.

- Look for areas where you can cut back on expenses.

- Save money by automating your savings and paying yourself first.

Frequently Asked Questions

Are you new to budgeting and unsure where to start? Don’t worry, we’ve got you covered! Here are some common questions beginners have about budgeting money, along with detailed answers to help you get started on the right track.

1. How do I create a budget?

Creating a budget is the first step towards managing your finances effectively. Start by tracking your income and expenses for a month. Make a list of all your income sources, such as salary, freelance work, or rental income. Next, list all your expenses, including fixed expenses like rent and utilities, as well as variable expenses like groceries and entertainment.

Once you have a clear picture of your income and expenses, allocate your income to different categories based on priority. Set aside money for essential expenses first, such as rent and groceries. Then, allocate funds for savings, debt repayment, and discretionary spending. Continuously track your expenses and adjust your budget as needed to ensure you’re staying on track.

2. How can I save money while budgeting?

Saving money is an important aspect of budgeting. To save money, start by identifying areas where you can cut back on expenses. Look for subscriptions or services you no longer use and cancel them. Consider cooking meals at home instead of eating out, and try to limit impulse purchases.

Another effective way to save money is by automating your savings. Set up automatic transfers from your checking account to a separate savings account each month. This way, you’ll be consistently saving without having to think about it. Remember, even small amounts add up over time, so don’t underestimate the power of saving a little each month.

3. How can I stick to my budget?

Sticking to a budget can be challenging, but with some strategies, you can stay on track. Firstly, set realistic expectations for yourself. It’s important to allow some room for occasional splurges or unexpected expenses. Plan for them in your budget to avoid feeling deprived.

Additionally, find ways to stay motivated. Set financial goals for yourself, such as saving for a vacation or paying off debt. Visualize the benefits of sticking to your budget and remind yourself of them regularly. Consider using budgeting apps or tools to help you track your progress and stay accountable.

4. How do I handle irregular income when budgeting?

Managing irregular income can be tricky, but it’s not impossible. Start by creating a budget based on your minimum expected income. This means estimating the lowest amount you’re likely to earn in a given month. Prioritize your essential expenses and savings based on this minimum income.

When you receive additional income, such as a bonus or freelance payment, allocate it towards specific goals or savings categories. This allows you to make progress on your financial goals while still covering your necessary expenses during months with lower income. Adjust your budget as your income fluctuates to ensure you’re effectively managing your money.

5. How long does it take to see results from budgeting?

The timeframe for seeing results from budgeting varies for each individual. It depends on factors such as the amount of debt you have, your income level, and your spending habits. However, with consistent budgeting and financial discipline, you can start seeing positive changes within a few months.

Keep in mind that budgeting is a long-term practice. It’s not a quick fix but a sustainable way to manage your money. Over time, you’ll develop better financial habits, pay off debts, and build savings. Remember to celebrate small milestones along the way to stay motivated and encouraged on your budgeting journey.

Budgeting for Beginners – How to Make a Budget From Scratch 2021

Final Summary: Mastering the Art of Budgeting

Congratulations, you’ve reached the end of our budgeting journey for beginners! By now, you should have a solid understanding of how to budget your money effectively. Remember, budgeting is not about restricting yourself, but rather about gaining control and financial freedom. Let’s quickly recap the key takeaways from our discussion.

Firstly, start by setting clear financial goals. Whether it’s saving for a dream vacation or building an emergency fund, having specific goals will give you motivation and direction. Secondly, track your expenses diligently using budgeting tools or apps. This will help you identify areas where you may be overspending and allow you to make necessary adjustments.

Next, prioritize your spending by distinguishing between needs and wants. Cut back on non-essential expenses and allocate more funds towards your financial goals. Additionally, consider automating your savings to ensure consistent progress. Pay yourself first by setting up automatic transfers to your savings account.

Moreover, don’t be afraid to negotiate and seek out better deals on your regular bills, such as utilities or insurance. Every dollar saved counts! Finally, be flexible and adjust your budget as needed. Life is full of unexpected surprises, so it’s important to adapt your financial plan accordingly.

Remember, budgeting is a skill that takes time and practice to master. Be patient with yourself and stay committed to your financial goals. With discipline and determination, you’ll soon find yourself in a much stronger and more stable financial position.

So go ahead, take control of your money, and start budgeting like a pro. Your future self will thank you for it. Happy budgeting!