So you’re curious about how venture capital makes money? Well, you’ve come to the right place! Venture capital is an exciting world where investors have the opportunity to support and profit from innovative startups. But how exactly do they turn their investments into profits? Let’s dive in and explore the fascinating ways venture capital makes money.

Venture capital firms make money primarily through two methods: capital gains and management fees. When a venture capitalist invests in a startup, they typically acquire equity in the company. As the startup grows and achieves success, the value of their equity increases. This is where capital gains come into play. When the startup is sold or goes public, the venture capitalist can sell their equity at a higher price, thus realizing a profit. It’s like planting a seed and watching it grow into a thriving tree!

In addition to capital gains, venture capital firms also charge management fees. These fees are typically a percentage of the capital committed by their investors. The purpose of management fees is to cover the operational costs of the venture capital firm, including salaries, office space, and due diligence expenses. So, while venture capitalists make money through the growth and success of their investments, they also generate income through the management fees they charge their investors. It’s a win-win situation for everyone involved!

How Does Venture Capital Make Money?

Venture capital is a form of financing that is provided to startups and early-stage companies by investors known as venture capitalists. These investors provide funds to these companies with the expectation of generating a return on their investment. So, how exactly does venture capital make money? Let’s explore this topic in detail.

Equity Investments

Venture capitalists typically make money through equity investments in the companies they fund. When a venture capitalist invests in a startup, they receive a certain percentage of ownership in the company in exchange for their investment. This ownership stake is represented by equity shares or stock options. As the company grows and becomes more valuable, the value of the venture capitalist’s equity stake also increases. This is how venture capitalists make money through capital appreciation.

In addition to the initial equity investment, venture capitalists may also participate in subsequent funding rounds as the company progresses. This allows them to further increase their ownership stake and potentially realize even greater returns when the company goes public or is acquired by another company. By investing in multiple startups and diversifying their portfolio, venture capitalists increase their chances of finding the next big success and generating substantial profits.

Exit Strategies

One of the key ways venture capitalists make money is through exit strategies. An exit strategy is a plan for how the venture capitalist will eventually sell their equity stake and realize their return on investment. There are several common exit strategies that venture capitalists employ, including initial public offerings (IPOs) and acquisitions.

When a company goes public through an IPO, it offers its shares to the public for the first time on a stock exchange. This allows venture capitalists to sell their equity stake in the company and generate profits. IPOs can be highly lucrative for venture capitalists if the company’s stock price increases significantly after the initial offering.

Acquisitions are another common exit strategy for venture capitalists. In an acquisition, a larger company buys out the startup or early-stage company, often at a premium price. This allows the venture capitalist to sell their equity stake and earn a return on their investment. Acquisitions can be advantageous for venture capitalists as they provide a quicker and more certain exit compared to waiting for a company to go public.

By carefully selecting their investments and actively managing their portfolio, venture capitalists aim to identify companies with the potential for successful exit strategies. This involves evaluating the market potential, growth prospects, and competitive advantage of the companies they invest in. Through strategic decisions and guidance, venture capitalists work towards maximizing the value of their investments and ultimately making money.

The Role of Fund Management

In addition to equity investments and exit strategies, venture capitalists also generate income through fund management. Venture capital firms raise funds from various sources, such as institutional investors and high-net-worth individuals. These funds are then used to invest in startups and early-stage companies.

Venture capital firms typically charge a management fee based on the total capital committed to the fund. This fee covers the costs of operating the firm, including salaries, office expenses, and due diligence activities. The management fee is usually a small percentage of the total fund size and is paid annually by the investors.

In addition to the management fee, venture capital firms also earn carried interest, also known as the performance fee. Carried interest is a share of the profits generated by the fund’s investments. This is typically calculated as a percentage of the profits above a certain threshold, known as the hurdle rate. The venture capitalists receive a portion of these profits as their carried interest.

Fund management plays a crucial role in the success of venture capital firms. By effectively managing the fund, making strategic investment decisions, and providing support and guidance to portfolio companies, venture capitalists aim to generate attractive returns for their investors and themselves.

Building a Successful Portfolio

Venture capital firms build a diversified portfolio of investments to mitigate risk and increase the likelihood of achieving profitable outcomes. They carefully select startups and early-stage companies that have the potential for high growth and significant returns. By investing in a variety of industries, sectors, and stages of development, venture capitalists spread their risk and increase the chances of finding successful investments.

Diversification is important because not all investments will be successful. Some startups may fail to achieve their growth targets or face challenges in the market. However, venture capitalists aim to identify the winners in their portfolio that have the potential to generate substantial returns. These successful investments can more than make up for any losses incurred from unsuccessful ones.

In conclusion, venture capital makes money through equity investments, exit strategies, and fund management. Venture capitalists invest in startups and early-stage companies, aiming to generate capital appreciation as the companies grow and become more valuable. They also employ exit strategies such as IPOs and acquisitions to sell their equity stakes and realize their returns. Additionally, venture capital firms earn income through fund management fees and carried interest. By carefully managing their portfolio and diversifying their investments, venture capitalists work towards building a successful and profitable venture capital business.

Key Takeaways: How Does Venture Capital Make Money?

- Venture capitalists make money through equity investments in high-potential startups.

- They provide funding to startups in exchange for ownership stakes.

- When a startup succeeds, venture capitalists make a profit by selling their shares.

- They can also make money through dividends or interest on their investments.

- Venture capitalists typically invest in multiple startups to diversify their risk and increase their chances of making money.

Frequently Asked Questions

Here are some frequently asked questions about how venture capital makes money:

What is venture capital?

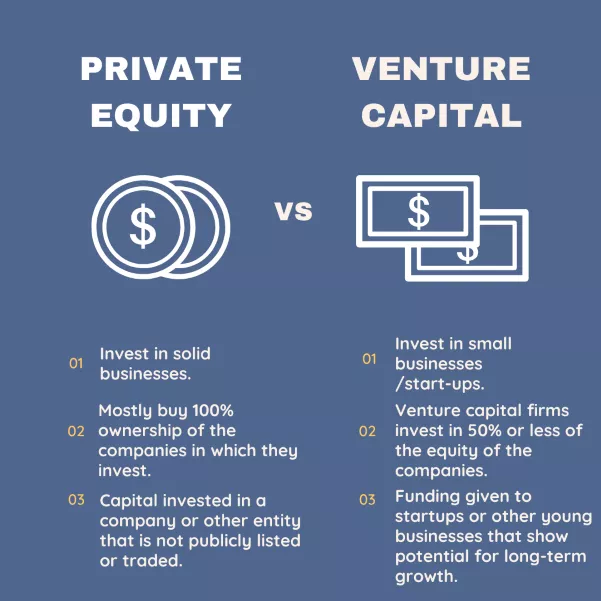

Venture capital is a type of financing provided to startups and early-stage companies that have high growth potential. Venture capitalists invest their own money or money from their firm into these companies in exchange for equity ownership.

They take on high levels of risk by investing in these early-stage companies, but they also expect high returns if the company is successful. Venture capital firms typically invest in industries such as technology, biotech, and clean energy.

How do venture capitalists make money?

Venture capitalists make money through a combination of capital appreciation and exits. When they invest in a startup, they hope that the value of the company will increase over time. This can happen through growth in revenue, market share, or the company being acquired by a larger company.

Once the value of the company has increased, venture capitalists can exit their investment by selling their equity stake. This can be done through an initial public offering (IPO) where the company goes public, or through a merger or acquisition where another company buys the startup. The venture capitalist then receives a return on their investment, which can be several times their original investment.

Do venture capitalists only make money through exits?

No, venture capitalists can also make money through dividends and interest payments. While exits are the primary way for venture capitalists to realize their returns, some companies may choose to distribute profits to their investors in the form of dividends. This is more common in later-stage companies that have reached profitability.

In addition, venture capitalists may also receive interest payments on loans or convertible debt investments they make in startups. These interest payments provide a steady source of income while the company is still in its early stages and may not be generating significant revenue.

What are the risks involved in venture capital?

Venture capital investments are highly risky due to the nature of investing in startups and early-stage companies. These companies often have unproven business models, untested products or services, and uncertain market demand. As a result, there is a high risk of failure, and venture capitalists may lose their entire investment.

However, venture capitalists mitigate these risks by diversifying their portfolio and investing in multiple companies. They also conduct thorough due diligence before making an investment, evaluating factors such as the management team, market potential, and competitive landscape.

How do venture capitalists choose which companies to invest in?

Venture capitalists have a rigorous selection process to choose which companies to invest in. They look for startups with innovative ideas, strong management teams, and a large addressable market. They also consider factors such as the company’s competitive advantage, intellectual property, and potential for scalability.

Entrepreneurs seeking venture capital funding need to demonstrate a compelling business plan, a clear path to profitability, and a strong value proposition. They also need to show that they are open to mentorship and guidance from the venture capital firm, as they often play an active role in helping the company grow and succeed.

How do venture capital firms make money?

Final Thought: How Venture Capital Makes Money

In conclusion, venture capital is a fascinating and lucrative industry that thrives on spotting innovative ideas and turning them into profitable ventures. By providing funding and expertise to early-stage companies, venture capitalists play a crucial role in the growth and success of startups. So, how exactly do they make money?

First and foremost, venture capitalists make money through equity ownership. When they invest in a startup, they typically receive a percentage of the company’s equity in return. This means that as the company grows and becomes more valuable, the venture capitalist’s stake also increases in value. When the startup eventually goes public or gets acquired, the venture capitalist can sell their equity at a higher price, generating substantial returns.

Additionally, venture capitalists generate revenue through management fees and carried interest. Management fees are an annual fee charged to the limited partners in the venture capital fund to cover operational expenses. Carried interest, on the other hand, is a percentage of the profits earned by the fund. This means that when the fund successfully exits an investment and realizes a profit, the venture capitalists receive a share of those profits.

In summary, venture capitalists make money through equity ownership, management fees, and carried interest. They take calculated risks by investing in early-stage companies with the potential for significant growth and returns. By supporting and nurturing these startups, venture capitalists not only drive innovation but also create opportunities for themselves and their investors to reap substantial financial rewards. So, the next time you hear about a successful startup, remember that behind its triumph lies the strategic investments and financial expertise of venture capitalists.