Have you ever wondered how angel investors make money? Well, my friend, you’re in luck because today we’re going to dive deep into the world of angel investing and uncover the secrets behind their profit-making prowess. Angel investors, those generous souls who provide early-stage funding to startups, have a unique approach to making money that sets them apart from other investors. So, if you’re ready to uncover the strategies and tactics that angel investors employ to turn their investments into cold hard cash, then buckle up and let’s get started!

When it comes to angel investors, they don’t just sit back and hope for the best. Oh no, they are actively involved in the success of the startups they invest in. They bring more than just money to the table; they bring their expertise, network, and guidance to help the startups navigate the treacherous waters of the business world. By doing so, they increase the chances of success for their investments, which ultimately leads to higher returns.

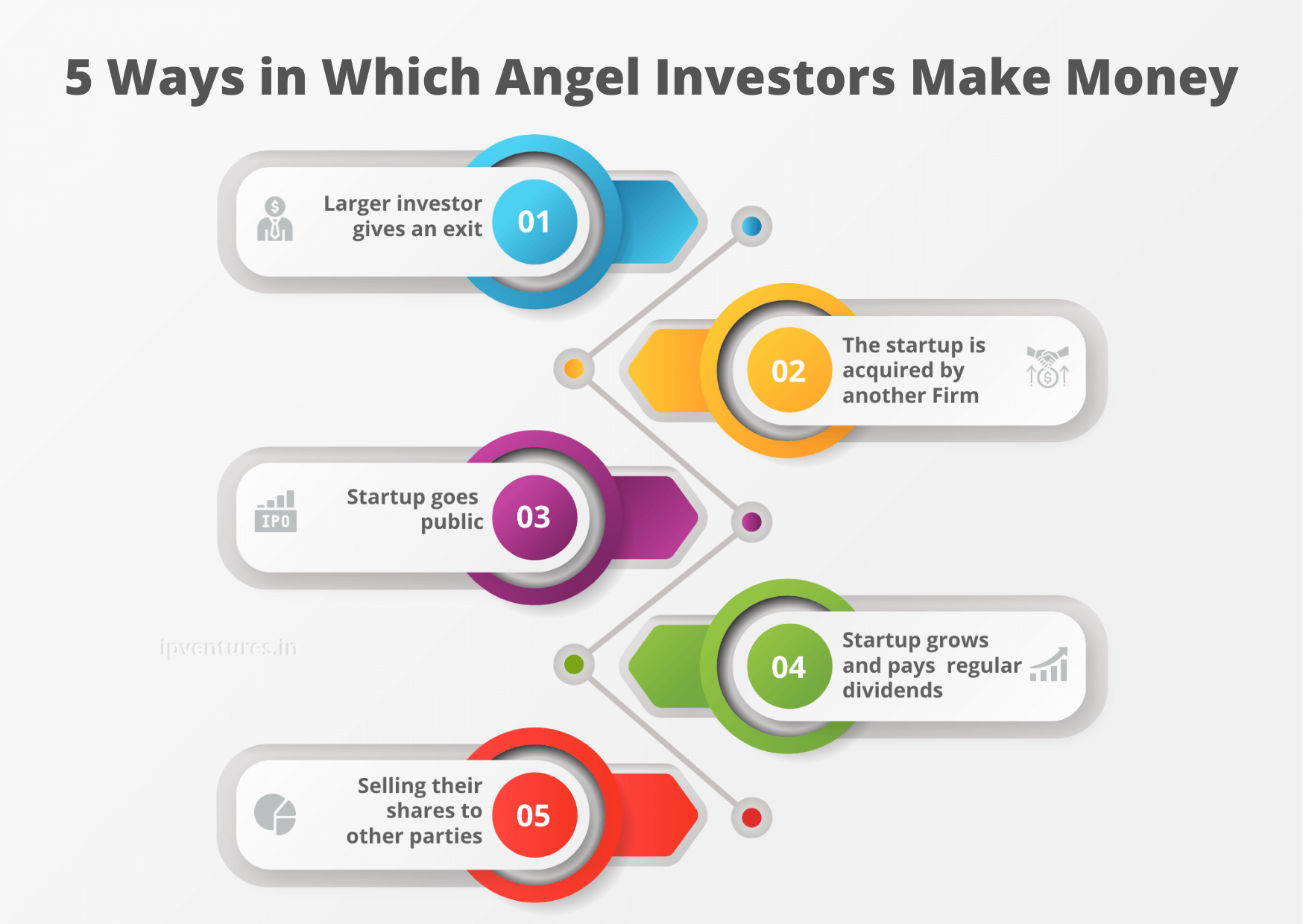

But that’s not all! Angel investors also make money through the eventual exit of their investments. This can happen in a few different ways, such as through an acquisition or an initial public offering (IPO). When a startup they’ve invested in is acquired by a larger company, the angel investor can make a handsome profit from the sale. Similarly, if the startup goes public through an IPO, the angel investor can sell their shares at a higher price, reaping the rewards of their early investment. So, you see, angel investors have a multi-pronged approach to making money, combining their active involvement with the eventual exit strategy. It’s a winning formula that has made many angel investors very wealthy indeed.

In conclusion, angel investors have a unique and strategic approach to making money. They not only provide funding to startups but also actively participate in their success. Through their involvement and guidance, they increase the chances of a successful exit, whether through acquisition or IPO, ultimately reaping the rewards of their early investment. So, the next time you come across an angel investor, remember that they are not just angels with money, but savvy individuals who know how to make a profit in the world of startups.

How Do Angel Investors Make Money?

Angel investors play a crucial role in funding startups and early-stage companies. They provide capital and support to entrepreneurs in exchange for equity in the company. But how exactly do angel investors make money? In this article, we will explore the various ways angel investors earn a return on their investments and the strategies they use to maximize their profits.

1. Equity Investment

When angel investors invest in a startup, they typically receive equity in the company. This means they own a percentage of the business and have a stake in its success. If the company grows and becomes profitable, the value of the angel investor’s equity increases. They can then sell their shares at a higher price, earning a profit on their initial investment.

Angel investors often invest in multiple startups to diversify their portfolio and increase their chances of finding a successful investment. They understand that not all startups will succeed, so they spread their investments across different industries and stages of development. By doing so, they mitigate the risk of losing all their capital if one investment fails.

Benefits of Equity Investment

Investing in equity allows angel investors to potentially earn significant returns on their investments. If a startup becomes successful and goes public or gets acquired, the angel investor can realize substantial profits. Additionally, by owning equity in the company, angel investors can have a say in the company’s decision-making process and contribute their expertise and connections to help the startup grow.

However, it’s important to note that equity investments are high-risk investments. Startups have a high failure rate, and angel investors must be prepared to lose their entire investment if the company fails. That’s why angel investors carefully evaluate startups and their potential for success before making an investment.

2. Exit Strategies

Angel investors also make money through various exit strategies. An exit strategy is a plan for how an investor will sell their equity and realize a return on their investment. Some common exit strategies for angel investors include:

Initial Public Offering (IPO)

An IPO is when a privately held company offers shares of its stock to the public for the first time. If a startup achieves significant growth and decides to go public, angel investors can sell their shares during the IPO, often at a much higher price than their initial investment. This allows them to make a substantial profit.

Acquisition

Another exit strategy for angel investors is through an acquisition. If a larger company sees potential in a startup and wants to acquire it, they may offer to buy the company. Angel investors can then sell their shares to the acquiring company at a negotiated price, earning a return on their investment.

Secondary Market

In some cases, angel investors may sell their shares on the secondary market. The secondary market is where existing shares of privately held companies are bought and sold before they go public. This allows angel investors to exit their investment before an IPO or acquisition.

3. Dividends and Interest

While equity investments and exit strategies are the primary ways angel investors make money, they can also earn income through dividends and interest. Some startups may choose to distribute profits to their investors in the form of dividends. This provides a regular income stream for angel investors while they wait for an exit opportunity.

Additionally, angel investors may provide loans or convertible debt to startups. This means they lend money to the company with the expectation of earning interest or converting the debt into equity in the future. This allows angel investors to earn a return on their investment even before an exit event occurs.

Benefits of Dividends and Interest

Receiving dividends or interest payments can provide a steady income for angel investors, especially if they have invested in more mature startups that generate consistent profits. This can help offset the risks associated with equity investments and provide a more stable source of income.

In conclusion, angel investors make money through equity investments, exit strategies such as IPOs and acquisitions, as well as dividends and interest payments. They carefully select startups to invest in and diversify their portfolio to mitigate risks. While investing in startups can be risky, successful investments can yield significant returns, making angel investing an attractive option for individuals looking to support and profit from the entrepreneurial ecosystem.

Key Takeaways: How Do Angel Investors Make Money?

- Angel investors make money by investing in early-stage startups and earning returns on their investments.

- They typically invest their own personal funds into these startups.

- Angel investors make money through equity ownership, meaning they receive a share of the company in exchange for their investment.

- They also make money through exit strategies, such as selling their shares when the company goes public or gets acquired.

- Angel investors can also make money through dividends, which are periodic payments made by the startup to its shareholders.

Frequently Asked Questions

Question 1: What are angel investors and how do they make money?

Angel investors are individuals who provide financial support to startups and early-stage companies in exchange for equity in the company. They typically invest their own personal funds and take on a high level of risk. Angel investors make money through various avenues:

Firstly, they make money through capital appreciation. If the company they invest in is successful, the value of their equity stake will increase over time. This allows them to sell their shares at a higher price and make a profit.

Question 2: Do angel investors receive dividends?

No, angel investors do not typically receive dividends. Unlike traditional investors who may receive regular payouts from the company’s profits, angel investors are more focused on long-term capital appreciation. Their main goal is to see the company grow and eventually exit the investment with a substantial return.

Instead of dividends, angel investors usually make money through an exit event, such as an acquisition or an initial public offering (IPO), where they can sell their shares and realize their profits.

Question 3: What is an exit event and how does it benefit angel investors?

An exit event refers to a situation where angel investors can sell their shares and make a profit. This can happen through various means, such as a company being acquired by another firm or going public through an IPO.

When an exit event occurs, the value of the angel investor’s equity stake is realized, and they can sell their shares at a higher price than what they initially invested. This allows them to make a significant return on their investment and generate profits.

Question 4: Are there any other ways angel investors make money?

Yes, apart from capital appreciation and exit events, angel investors can also make money through convertible notes or convertible securities. These are debt instruments that can be converted into equity at a later stage.

By offering convertible notes, angel investors can provide funding to startups and receive interest payments in the form of future equity. If the company performs well, the investor can convert their debt into equity and benefit from the company’s growth.

Question 5: What are some risks angel investors face in making money?

Angel investing involves a high level of risk, and there are several factors that can affect an angel investor’s ability to make money:

One common risk is the failure of the startup or early-stage company. If the company does not succeed or goes bankrupt, the angel investor may lose their entire investment.

Market conditions and economic factors can also impact an angel investor’s returns. If the market is not favorable or experiences a downturn, it may be difficult for the investor to sell their shares at a profitable price.

Additionally, angel investors may face dilution of their equity stake if the company raises additional funding rounds. This means that their ownership percentage in the company decreases, potentially impacting their potential returns.

Final Thought: How Do Angel Investors Make Money?

In conclusion, angel investors have a variety of ways to make money from their investments. Their primary goal is to provide capital to early-stage startups and help them grow. While there are risks involved, angel investors can see significant returns on their investments if they choose wisely and provide valuable guidance to the companies they invest in.

One of the main ways angel investors make money is through equity ownership. When an angel invests in a startup, they typically receive a percentage of the company’s equity in return. As the company grows and becomes more valuable, the angel’s share also increases in value. This can lead to substantial returns if the company is successful and eventually goes public or gets acquired.

Additionally, angel investors may also make money through dividends or profit-sharing agreements. Some startups may choose to distribute profits to their investors on a regular basis, providing a steady stream of income. This can be especially beneficial for angel investors who are looking for more immediate returns on their investments.

Furthermore, angel investors can also make money through the sale of their equity stake. As the startup progresses and reaches certain milestones, such as securing additional funding or achieving profitability, the angel investor may have the opportunity to sell their shares to other investors or strategic buyers at a higher price. This allows them to realize a profit on their initial investment.

Overall, angel investing can be a lucrative endeavor for those who are willing to take the risks. By providing capital and guidance to early-stage startups, angel investors can play a crucial role in fostering innovation and entrepreneurship. And with a well-diversified portfolio and a keen eye for promising opportunities, angel investors have the potential to make significant financial gains. So, if you’re considering becoming an angel investor, do your research, assess the risks, and seize the opportunity to make a positive impact on the startup ecosystem while potentially reaping substantial rewards.